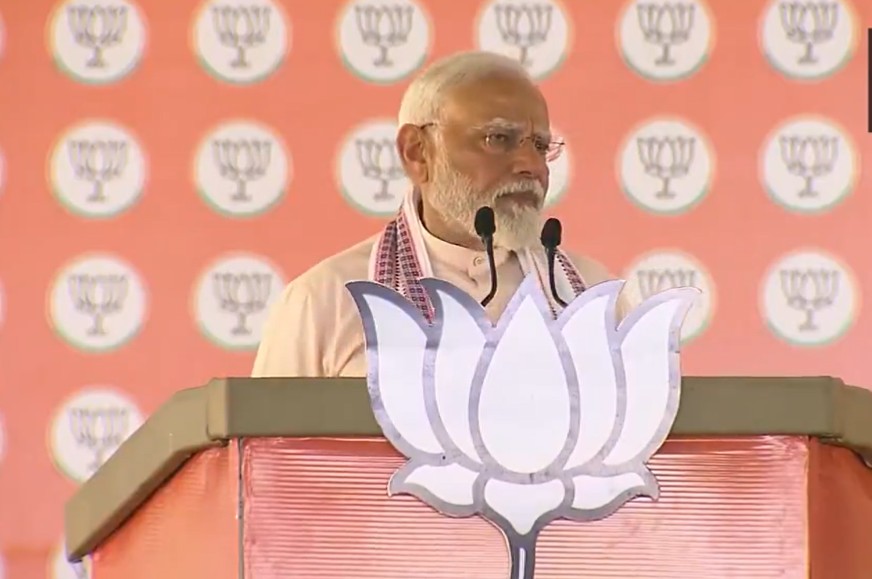

Prime Minister Narendra Modi, while addressing the Vijay Sankalp Rally in Morena, Madhya Pradesh, provided a nuanced analysis of the Inheritance Tax repeal, shedding light on its historical backdrop and political significance.

During his speech, Modi unveiled intriguing insights into the circumstances surrounding the Inheritance Tax during the tenure of former Prime Minister Indira Gandhi. He remarked, “The facts relating to Inheritance Tax are eye-opening…When former PM Indira Gandhi passed away, her children were slated to inherit her property. However, the prevailing law at the time stipulated that a portion of the property must be subjected to government taxation before it could be passed down to the heirs.” Modi went on to elucidate how, in a bid to safeguard the family’s assets from such taxation, the then-Prime Minister Rajiv Gandhi took the decisive step of abolishing the Inheritance Tax law.

Modi’s revelations at the Vijay Sankalp Rally provided a deeper understanding of the historical context and political motivations behind the Inheritance Tax repeal, highlighting the intricate relationship between taxation policies and political exigencies.

The Prime Minister’s address served as a platform for the BJP to disseminate information and rally support for its policies while critiquing the opposition.

Modi’s exposition is expected to spark debates and discussions, particularly concerning the implications of the Inheritance Tax repeal on fiscal policies and governance. As citizens reflect on this newfound knowledge, they will likely evaluate its relevance to contemporary economic frameworks and political decision-making.

The Prime Minister’s speech not only educated the public but also underscored the BJP’s commitment to transparency and accountable governance. As India heads towards elections, such elucidations of past policy decisions are poised to resonate with voters and influence their perceptions of political leadership.