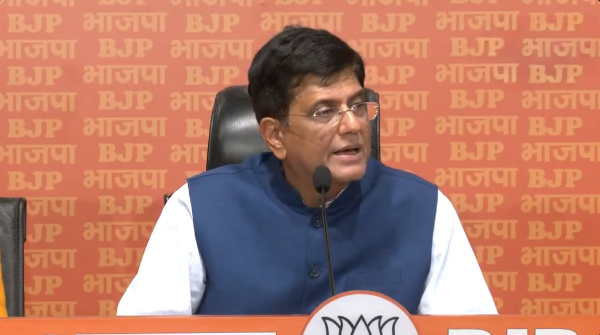

In a recent statement, BJP leader Piyush Goyal highlighted the significant shift in the Indian stock market’s ownership. He pointed out that the holding of foreign investors has decreased from 21% during the UPA regime to 16% today. This change indicates a reduction in foreign investment and an increase in Indian investors’ ownership in the stock market from 79% to 84%.

Goyal emphasized the growth of the mutual fund industry, which has seen a more than five-fold increase from Rs 10 lakh crore in 2014 to Rs 56 lakh crore today. He attributed this growth to Indian investors, particularly small investors, who are reaping the benefits of the burgeoning market through mutual funds.

The BJP leader also noted that these small retail investors have ensured that India’s ownership in the market today surpasses that of institutional investors. This shift underscores the growing influence and participation of retail investors in the country’s financial markets.

Goyal’s statement comes at a time when the Indian economy is witnessing significant changes, with increased participation from domestic investors in the stock market. This trend is expected to continue as more Indians become financially literate and take active roles in managing their investments.

The shift in market ownership from foreign to domestic investors is a positive sign for the Indian economy, reflecting increased confidence and participation in the country’s financial future. As the mutual fund industry continues to grow, it will provide more opportunities for small investors to benefit from the country’s economic growth.

In conclusion, the increased ownership of Indian investors in the stock market is a testament to the country’s economic resilience and the growing financial literacy among its citizens. It’s a trend that is likely to continue, contributing to the overall health and growth of the Indian economy.