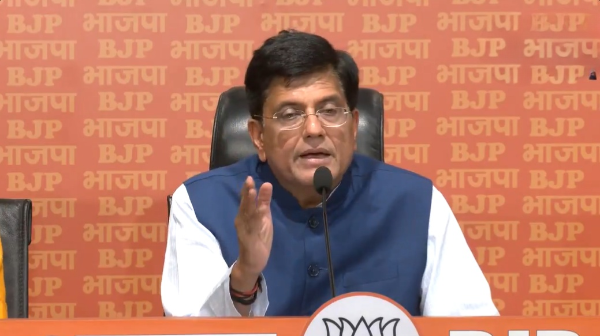

In a recent statement, BJP leader Piyush Goyal highlighted the strategic moves of Indian investors during the market fluctuations in April and May. He claimed that Indian investors capitalized on the market’s rise, reaping the benefits of this upward trend over the last two months.

According to Goyal, on the day the exit poll results were announced, foreign investors bought at high prices. In contrast, Indian investors sold at these high prices, thereby securing profits. Foreign investors reportedly bought Rs 6,850 crores in retail at these elevated prices, providing an opportunity for Indian investors.

The scenario changed the following day when the election results were announced. The market experienced a dip, and foreign investors sold at a low price. However, Indian investors, confident in the incoming Modi government, bought at this low price, anticipating future gains.

Goyal emphasized that this cycle of buying high and selling low by foreign investors, and selling high and buying low by Indian investors, resulted in profits for Indian investors even during this period of market volatility. He assured that no one suffered a loss during this period.

Goyal also addressed Rahul Gandhi’s comments about Rs 30 lakh crores, stating that Gandhi’s lack of understanding about market valuation has led to a loss of faith among the people. He clarified that valuation does not hold any significance; instead, the act of buying and selling is what matters. He concluded by stating that foreign investors incurred losses during this period, while Indian investors benefited, including retail investors.

This statement from Goyal underscores the resilience and strategic thinking of Indian investors during periods of market uncertainty, highlighting their ability to navigate and profit from market volatility.